⚖️ What is the S&P 500 Equal Weight Index? An Investor's Guide

⚖️ What is the S&P 500 Equal Weight Index? (A Guide for Investors) ⚖️

When people talk about "the market," they are often referring to the S&P 500. It is the most famous benchmark for the U.S. stock market. But what many investors do not realize is that there is more than one way to invest in those 500 companies. This brings us to an important alternative: the S&P 500 Equal Weight Index.

Understanding the difference between the standard S&P 500 and its equal-weight cousin is a key concept for any savvy investor. It is a simple switch that can have a big impact on your portfolio's performance and diversification.

This guide will explain the crucial difference between these two strategies. We will cover the pros and cons of an equal-weight approach. Let's dive in. 📈

🤔 How Does the Standard S&P 500 Work? (Market-Cap Weighted)

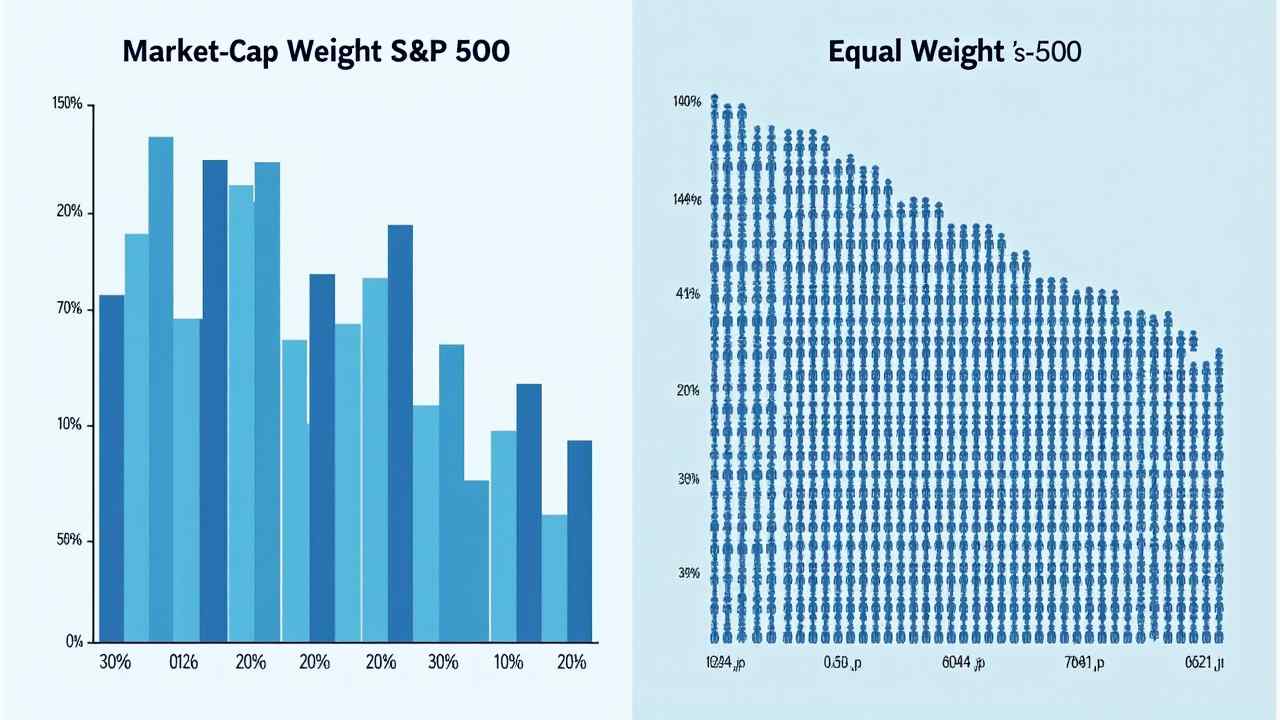

The standard S&P 500 Index that you hear about on the news is market-capitalization weighted. This is a very important concept. It means that the companies with the largest market value (their stock price multiplied by the number of shares) have the biggest influence on the index.

In today's market, this means that a handful of mega-cap technology stocks (like Apple, Microsoft, NVIDIA, and Amazon) make up a huge portion of the index. The performance of these few giants heavily dictates the overall return of the S&P 500. If these top stocks have a great year, the index does well. If they have a bad year, they can drag the entire index down.

- How is the S&P 500 Equal Weight Index Different?

The S&P 500 Equal Weight Index takes a radically different and simpler approach. It invests in the exact same 500 companies. But, as the name suggests, it gives every single company the exact same weight. This changes everything.

In this index, each company makes up 1/500th, or 0.2%, of the total portfolio. This means the performance of the 500th largest company has the exact same impact on your return as the performance of the #1 largest company. The index is typically rebalanced every quarter to maintain this equal weighting.

👍 What Are the Pros of an Equal-Weight Strategy?

Choosing to invest in an S&P 500 equal weight strategy has several key advantages. It is all about improving your diversification and avoiding concentration.

- It Reduces Concentration Risk: This is the number one benefit. You are not overly exposed to the fate of a few giant companies. It provides a much broader and more diversified exposure to the entire U.S. economy.

- It Increases Mid-Cap Exposure: The equal-weight index gives you significantly more exposure to the "smaller" companies in the S&P 500 (mid-cap stocks). Historically, smaller companies have often provided higher growth potential than large-cap stocks.

- It Enforces Discipline: The quarterly rebalancing process is a form of disciplined "buy low, sell high." It automatically forces you to trim your positions in the stocks that have performed well and add to the positions that have underperformed.

👎 What Are the Cons to Consider?

There are also a few trade-offs to be aware of. The main disadvantages of an S&P 500 equal weight strategy are:

- Higher Expense Ratios: Exchange Traded Funds (ETFs) that track the equal-weight index typically have higher management fees than the ultra-low-cost funds that track the standard S&P 500.

- Underperformance During Mega-Cap Rallies: In years when the market is being driven by the explosive growth of a few giant tech stocks, the equal-weight index will almost certainly underperform the standard market-cap index.

For investors, the easiest way to access this strategy is through an ETF. The most popular one is the Invesco S&P 500 Equal Weight ETF (ticker symbol: RSP). It is a simple and effective tool for any long-term investor's portfolio. 💰